[Report] Global Assessment Report (GAR) on Disaster Risk Reduction 2025

Global Assessment Report (GAR) 2025: Resilience Pays: Investing and Financing for Our Future

The global cost of disasters is growing: The economic burden of disasters is intensifying. While the direct costs of disasters averaged USD 70-80 billion a year between 1970 and 2000, between 2001 and 2020 these annual costs grew significantly to USD 180-200 billion. But the real cost is far higher.

Disaster costs now exceed over USD 2.3 trillion annually when cascading and ecosystem costs are taken into account. The “Global Assessment Report (GAR) 2025: Resilience Pays: Financing and Investing for our Future” highlights how smarter investment can re-set the destructive cycle of disasters, debt, un-insurability and humanitarian need that threatens a climate-changed world.

This report was produced by the United Nations Office for Risk Reduction (UNDRR). The UN Futures Lab/Global Hub partnered in this project to bring a futures lens and explore what the choices we make in the present mean for our shared future.

“This year’s Global Assessment Report on Disaster Risk Reduction examines the risks posed by disasters from now to 2050 and presents an indisputable case for action. This report clearly shows that investing in disaster risk reduction saves money, saves lives, and lays the foundation for a safe and prosperous future for us all. I urge all leaders to heed that call.”

– António Guterres, United Nations Secretary-General

Investing in resilience

There is a stark mismatch between the increasing levels of global risk and current investment in resilience. When disasters occur repeatedly, economic growth often slows and debt increases. Developing countries face the dual challenge of higher exposure to hazard risk and limited access to resources for risk reduction. In such situations, it becomes increasingly expensive to insure or otherwise transfer risk, and more money is spent on humanitarian responses as disasters are not prevented. But this is not inevitable.

Acting today can shift the disaster risk narrative – from one of rising costs and instability to one of resilient, inclusive, and sustainable development.

The Three Spirals

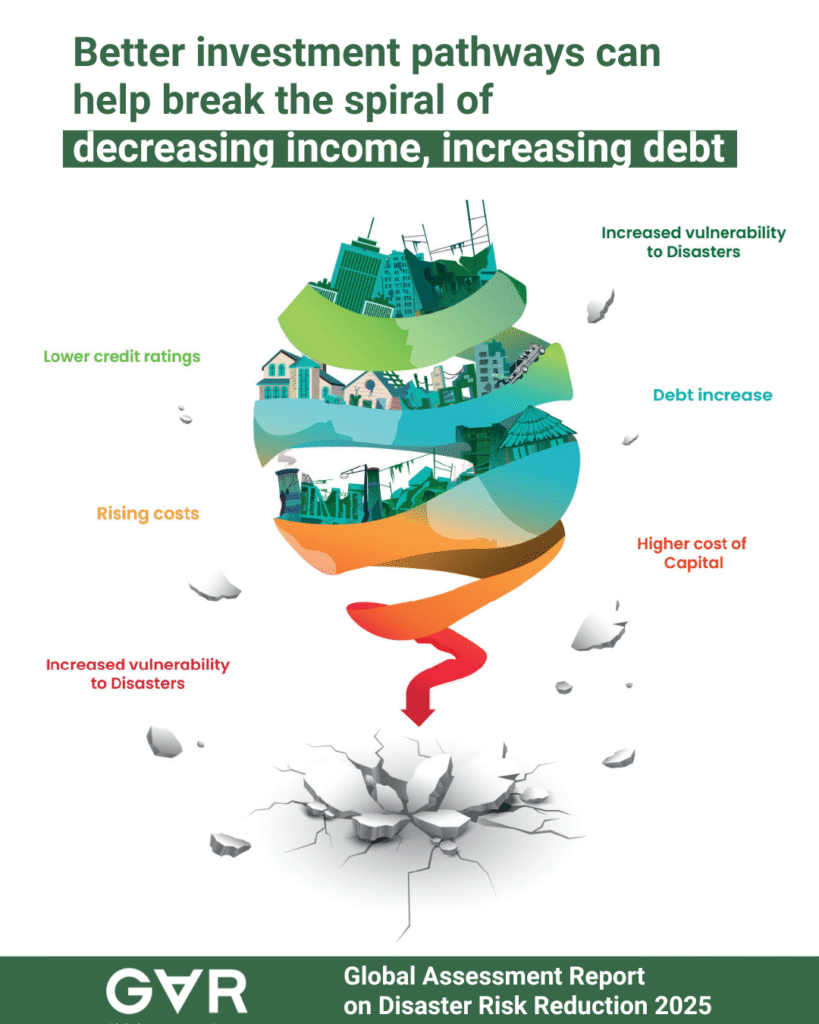

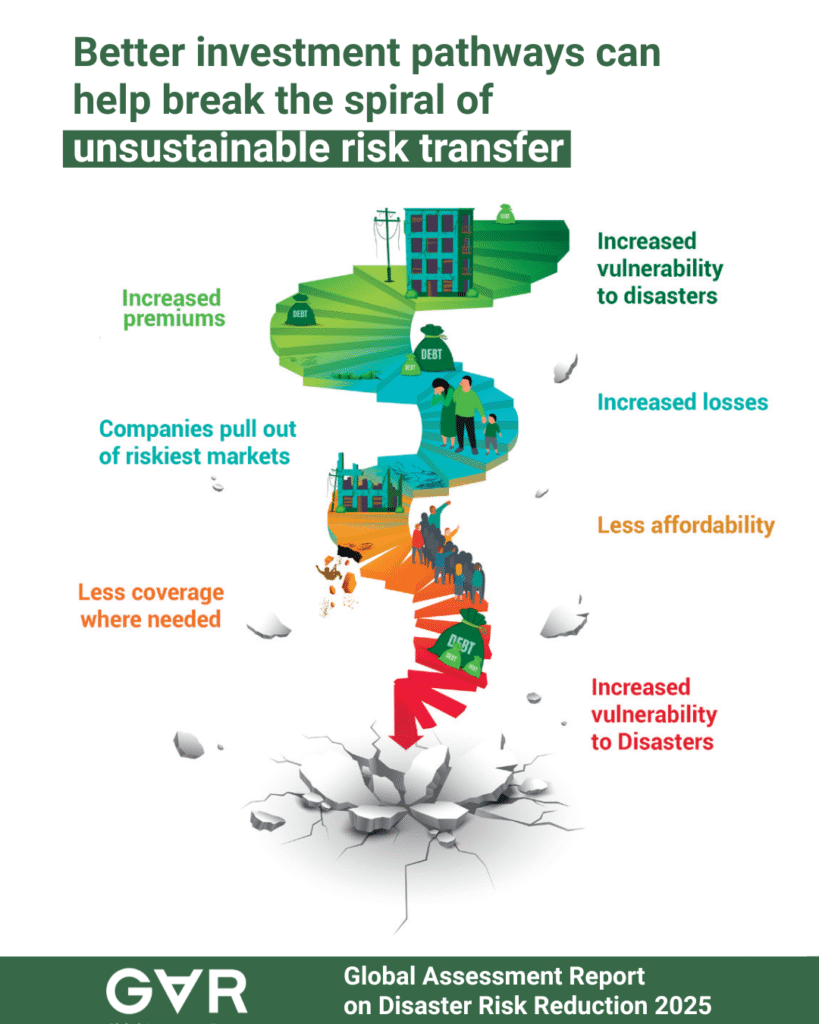

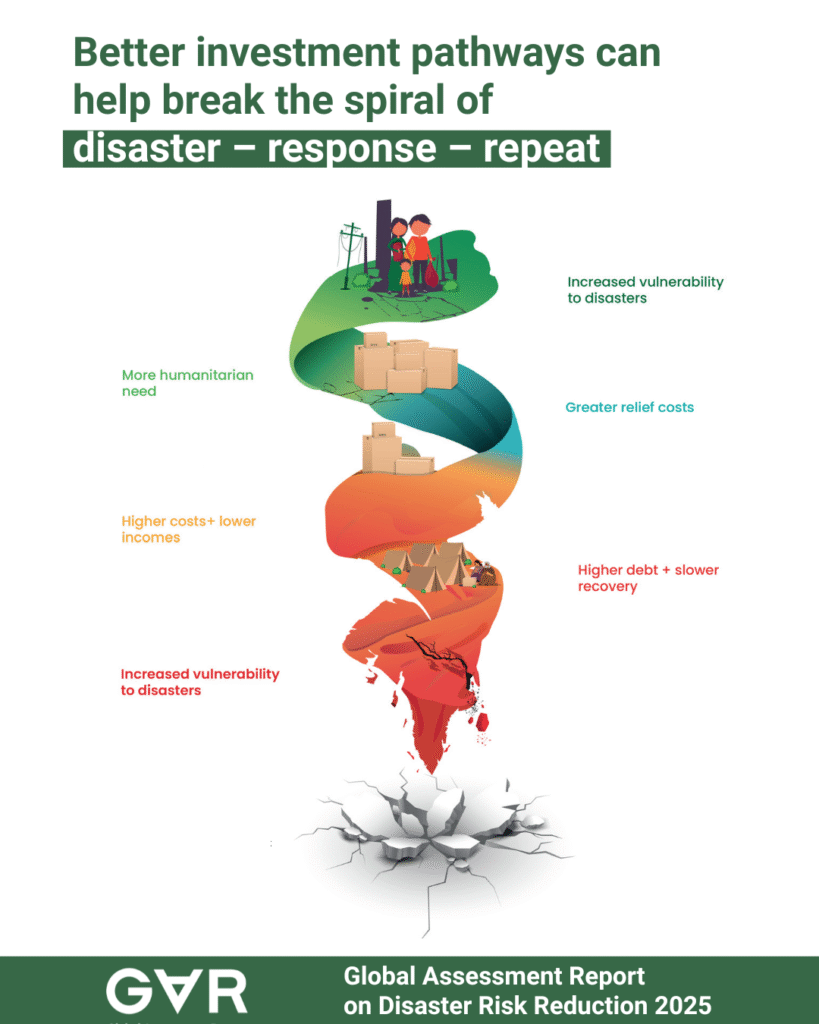

Current investment patterns fuel spirals that increased debt and decreased income, foster un-insurability and perpetuate and expensive dependence on humanitarian assistance.

- Spiral One: Increasing Debt, Decreasing home. This occurs when a lack of disaster risk reduction leads to recurrent excessive losses, in the process reducing household income and depleting national assets.

- Spiral Two: Unsustainable Risk Transfer. Even in wealthier regions, only about a quarter of climate-related catastrophe losses are currently insured. As a result, central governments are shouldering an increasingly heavy burden of hazard-related risk.

- Spiral Three: Respond-Repeat. This is related to the humanitarian response cycle. Emergency relief in the wake of disasters saves lives, but is often expensive and not designed to have a long-term impact on disaster recovery or to address underlying vulnerabilities.

Your choice

The world is facing an increasingly volatile future. Human choices – from energy consumption to land use planning – play a crucial role in shaping future vulnerability and exposure.

To explore how the choices we make in the present impact our shared future, the UN Futures lab/Global Hub designed and facilitated a strategic foresight process for the GAR 2025 with experts from academia, international organizations, the private sector and insurance leaders.

The foresight process aimed to answer three key questions: Which global trends and disruptions are most critical to shaping these futures? What are the potential trade-offs and conflicts between stakeholder priorities? Are there gaps in the current data that need to be addressed?

Two possible trajectories:

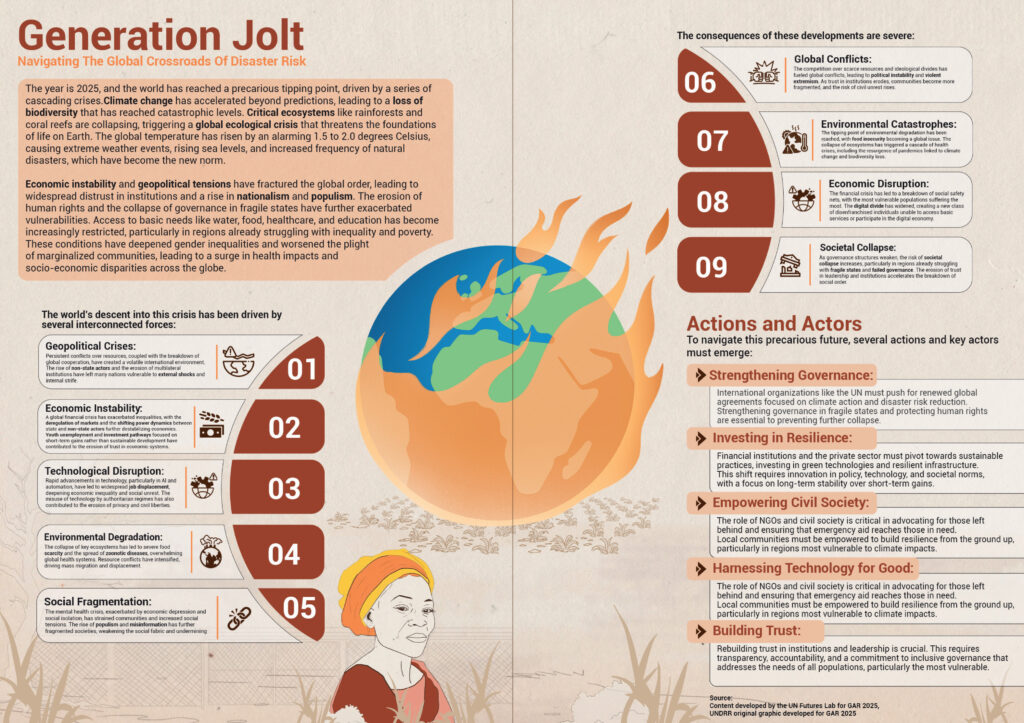

- “Generation Jolt”: A high-risk, high-regret future, where resilience investment is lacking, and extreme climate and disaster impacts take a toll on the people, planet and prosperity.

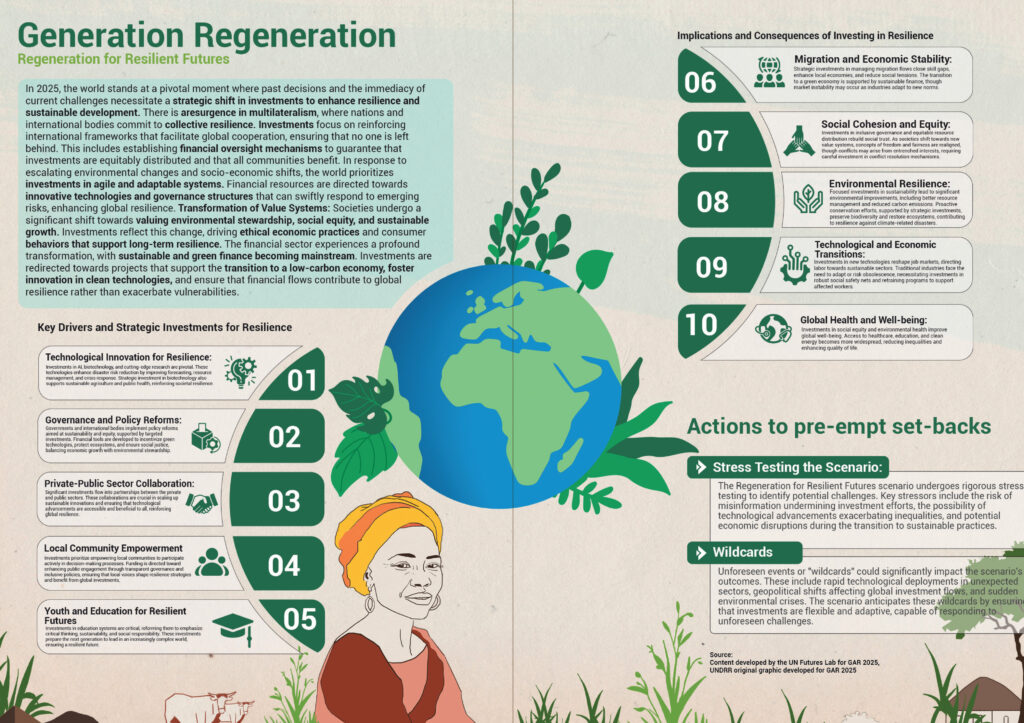

- “Generation Regeneration”: A resilient future shaped by renewed global cooperation, flexibility to adapt, a transformation in value systems and a revolutionized financial sector.

These contrasting trajectories highlight the profound impact of today’s decisions the lives of the next generation.

Breaking the spirals

Pragmatic action now to reduce disaster risk in advance can slow and potentially even reverse each of the negative spirals. Doing so requires a shift in how governments, financial institutions and the private sector approach investments.

- Breaking Spiral One: Protecting household income and ensuring more sustainable debt

- Breaking Spiral Two: Fixing risk-transfer finance

- Breaking Spiral Three: Preventing the response-repeat spiral

Act now: Resilience pays

Investing in disaster risk reduction is no longer optional – it is essential for protecting financial stability and enabling long-term development. GAR 2025 makes it clear that managing risk for the 21st century requires action in six key areas:

- Democratize risk understanding

- Use public financing and regulation to break the risk-creation addiction

- Innovate to keep risk transfer and insurance sustainable

- Make the business case

- Anticipate shocks to reduce humanitarian needs

- Leverage the multiplier effect of international financial mechanisms